Some of you may be asking “What the heck is travel hacking?” Travel hacking is leveraging credit card welcome bonuses doing your normal spending to fund trips of a lifetime. The basic strategy is opening a credit card with a welcome bonus, putting your normal purchases on this credit card to meet the minimum spending requirements to get the bonus, and using those bonus points to transfer to airline and hotel partners. You can start traveling for pennies on the dollar, and I’m here to show you how!

The first thing you need to know is what points and miles are.

Points and miles are a form of loyalty currency offered by various travel rewards programs, credit card issuers, airlines, and hotels. They are earned through specific activities such as making purchases with a co-branded credit card, staying at partner hotels, flying with partner airlines, or through promotions.

Here’s a breakdown:

- Points: Points are a form of loyalty currency that can be earned and redeemed for various rewards, such as free flights, hotel stays, upgrades, merchandise, gift cards, or cash back. These points are often accumulated through spending on credit cards or through loyalty programs associated with airlines, hotels, or other travel providers. My favorite way to accumulate these points is through credit card welcome bonuses.

- Miles: Miles are similar to points but are specifically associated with airline loyalty programs. They are earned based on the distance flown, class of service, and sometimes other factors like airline promotions, welcome bonuses, or credit card spending. Like points, miles can typically be redeemed for flights, upgrades, and other travel-related benefits.

Both points and miles can have varying values depending on how they’re redeemed. Some programs offer fixed-value points or miles where each point or mile is worth a certain amount towards travel expenses. In contrast, others offer variable-value points or miles where the value can fluctuate based on factors such as destination, time of booking, or class of service. Additionally, some programs allow for transferring points or miles to partner loyalty programs, which can provide opportunities for greater flexibility and value.

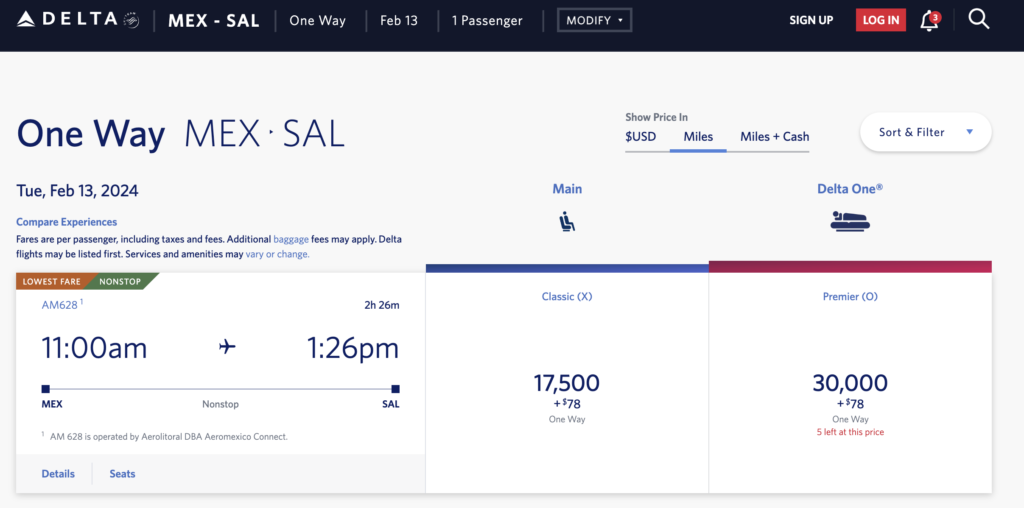

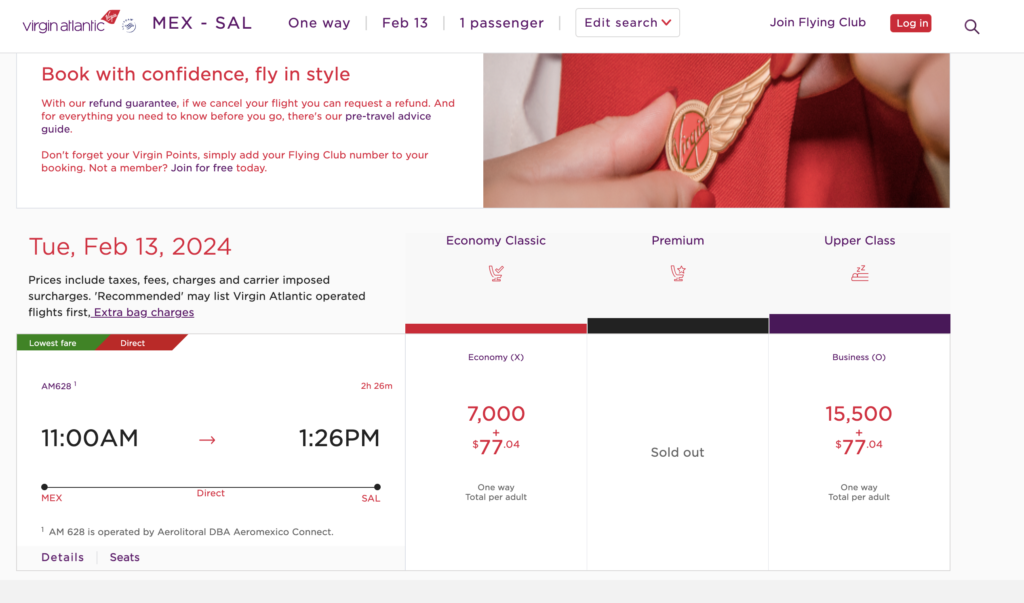

So, how do you get started? You need to decide where you want to travel. Whether you want to start small to get your feet wet, or you want to plan the most epic trip of your life, you need to have a goal and idea of where you want to go. Start by picking a destination and deciding what credit card and reward points you need to get there. Check out hotel chains in the area but if there is a local hotel that sparks your interest there are ways to make that work as well. Check out your home airport and find out if they are a hub for major airlines like Delta, American Airlines, United, etc. While you will not use the same airline, or airline alliance every time, it is a good idea to see where you would get the best flight deals, and start from there. You also want to explore airline alliances and partners to get the best bang for your points. For example, you can use transferable points to book a flight with Virgin Atlantic that may be double the points cost on the Delta Airlines site.

This is the knowledge that you will gain on an intermediate level, but my goal here is to get you started.

After you have decided where you want to go, you should start exploring the various ways you can earn the points to travel there.

There are 3 categories of points you can earn. Transferable points, which are my favorite, are the most flexible and allow you to transfer points from your credit card to airlines, and hotels, and have the option to cash out for cash back. I don’t recommend the cash-back option, because you can get so much better value transferring to hotels and airlines, and the goal is to get you traveling more!

Here are the most popular transferable points partners to get you started:

- American Express Membership Rewards®

- Bilt Rewards

- Capital One Mile

- Chase Ultimate Rewards®

- Citi ThankYou® Rewards

Airline miles can be redeemed for free flights, upgrades, lounge access, or other travel-related perks. Airline miles are a key component of frequent flyer programs and are designed to incentivize customer loyalty to a specific airline or airline alliance.

Here is a list of some of the larger airlines:

- United Airlines

- American Airlines

- Alaska Mileage

- Delta SkyMiles

- Spirit Airlines

- JetBlue Airlines

- Southwest Airlines

These larger airlines have airline alliances that you can use to extend your options and get the most out of your airline miles.

Here’s a look at the major hotel chains and their global footprint to help pick the destination you are looking for:

- Marriott Bonvoy: Over 8,000 properties in 139 countries

- Hilton Honors: Over 7,000 hotels in 122 countries

- Choice Privileges: Over 7,000 hotels in 40 countries

- IHG One Rewards: Over 6,000 properties worldwide

- Radisson Rewards: Over 1,700 hotels worldwide

- World of Hyatt: Over 1,150 hotels in 70 countries

Hotel points can be redeemed for rewards such as free nights, room upgrades, complimentary amenities, or other hotel-related benefits. Hotel points are a fundamental feature of hotel loyalty programs, aiming to encourage guest loyalty and repeat business.

Now that you have a good understanding of what types of points and miles programs are out there, it’s time to pick a credit card to start with. When choosing a credit card you should consider the following:

Welcome Bonus:

A great welcome bonus will help you choose the best and quickest way to achieve your travel goals. I aim for a welcome bonus of at least 60,000 points to get the most value.

Credit Card Application Policies:

Some banks have strict application rules when applying for credit cards. For example, American Express limits welcome bonuses to once per lifetime with some cards. Chase’s 5/24 rule prevents you from being approved for a new card if you’ve had five or more personal cards in the last 24 months.

You should familiarize yourself with these rules before applying for a card to avoid credit denial. If you are denied credit with most credit card companies( excluding Capital One), you can contact their reconsideration line for a closer look into your credit profile and it is possible to get the approval you are after.

Travel perks:

Many travel rewards cards come with valuable perks like elite status, airport lounge access, airline fee credits, rental car collision coverage, and annual free nights. It’s good to think about which travel perks you would maximize each year. This will help you decide if the card is worth renewing each year.

Annual fees:

Annual fees can add up and can range from $0-$695. If you are not likely to utilize all of the benefits a card has it may be worth considering cards with lower or no-annual-fee to get started.

Now that you have earned your welcome bonus, what is the best way to maximize your points to get the most out of your travel?

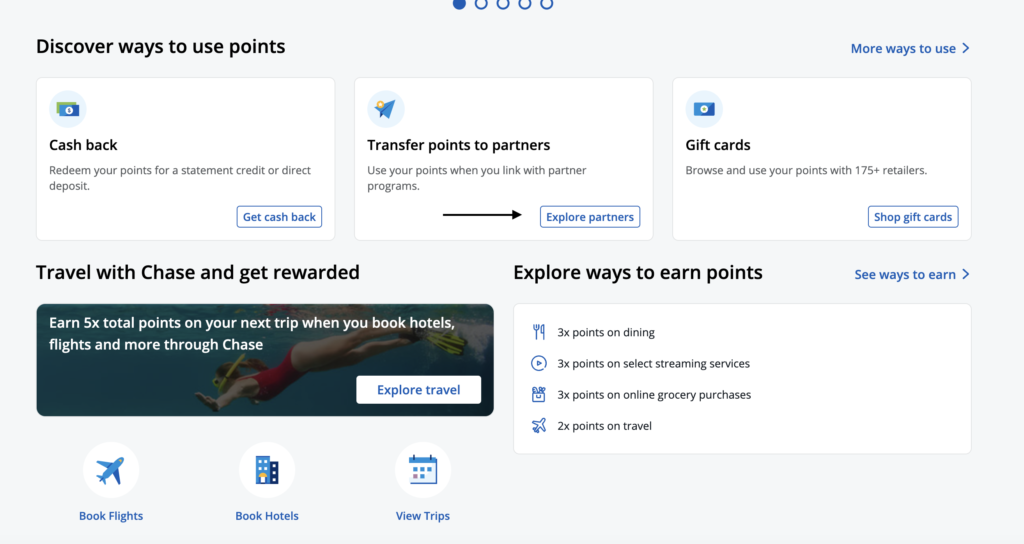

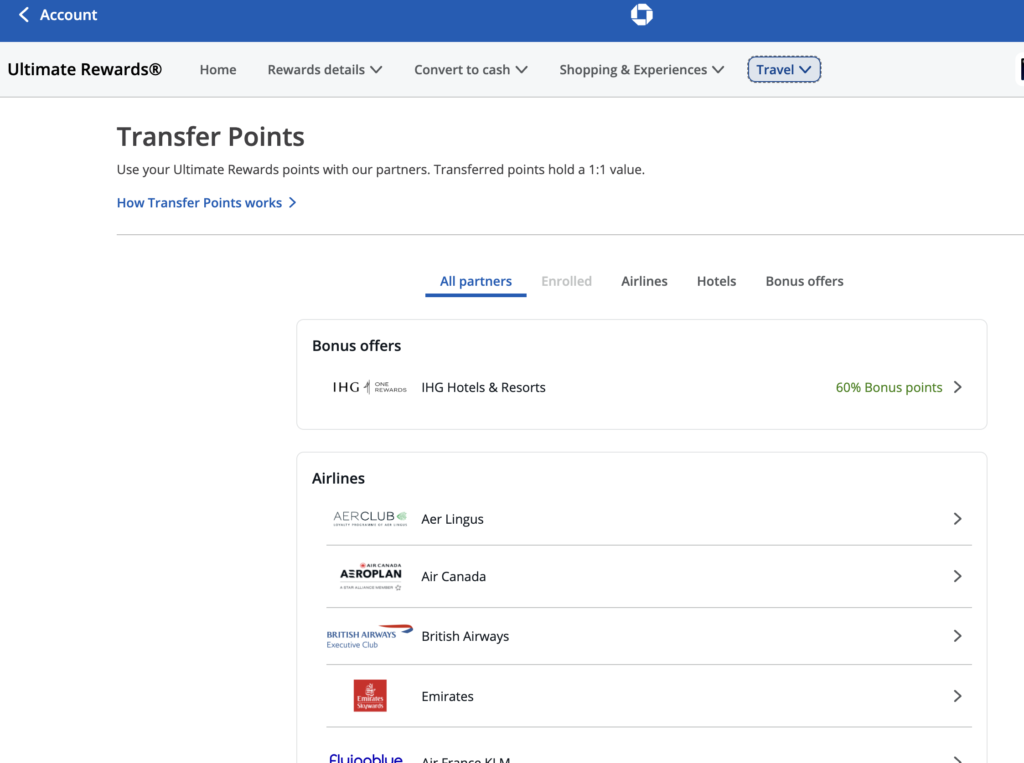

If you have been following along, transferable currency is my favorite way to stretch your points for maximum value. After receiving your welcome bonus you can find the transfer points option in your credit cards portal. This is what the Chase app looks like:

Each transferable points currency will have its specific transfer partners for flights and hotels. I find I get the most value with the Chase Sapphire Proffered card. Keep in mind, with Chase, you will need to select a credit card that offers the ability to transfer. These are cards that have annual fees, but the ability to transfer to partners is well worth paying the annual fee. Chase offers the Chase Sapphire Preferred ($95 annual fee), and the Chase Sapphire Reserve ($395 annual fee). There is also the option to apply for the Chase Ink Business Preferred card for transferrable points. I have a post about how to get a business credit card you can check out here. The best part is selling things on the Facebook marketplace counts as a business, so anyone can get a business credit card!

There are many ways to get the best bang for your points when transferring to partners like taking advantage of fourth and fifth night free.

Some hotel programs offer free nights when you redeem points for consecutive nights at one property. This can help you get a great deal when booking hotel free nights. The most generous is IHG One, which offers a fourth night free to IHG Rewards Traveler, IHG Rewards Premier, and IHG Rewards Premier Business card members. In comparison, Hilton elites and Marriott members offer the fifth night free on award bookings. All this said I find I get the best value from Hyatt stays with points redemptions starting as low as 5000 points/night for category 1 hotels. You can even book All-Inclusive with Hyatt starting as low as 12000 points/night. If that doesn’t get you excited I don’t know what will!

The most important takeaway is to be responsible with credit and never carry a balance. ALWAYS pay your balance in full each month, and if you can do that, my friends, you win the game!

In summary, by leveraging credit card welcome offers and bonuses, you can start traveling and making memories with your family, while not breaking the bank. Transferrable points reign supreme but there are great deals to be had with co-branded hotel and airline cards too so don’t sleep on those. I hope this post gives you what you need to get out there and start traveling. Feel free to reach out with any questions, I’ll do my best to respond in the comments below!

1 thought on “How to start travel hacking to make travel dreams come true! ”

Comments are closed.